Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment. Business activities trading finance management and human resources.

Corporate Tax Statistics Third Edition Oecd

The policy of gradual reduction of the corporate tax rate in Malaysia is suspected to have a positive impact on the productivity of Malaysian companies which has contributed to an increase in corporate tax revenue.

. The benchmark used pertains to the highest Corporate Income rate. Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. Update Company Information.

Tax Rate Of Company. Effective from year of assessment 2016 company tax rate will be reduced by 1 from. With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million.

The current maximum tax rate at 26 will be reduced to 24 245 and 25. In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018. Tax Rate of Company.

The current CIT rates are provided in the following table. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an. Corporate income tax in Malaysia is applicable to both resident and non-resident companies.

On subsequent chargeable income 24. For example the basis period for the YA 2016 for a company which closes its accounts on 30 June 2016 is the financial year ending 30 June 2016. Effective from YA 2016 The reduction of tax rate is in line with the reduction in the corporate income tax rate.

Company having gross business income from one or more sources for the relevant year of assessment of not more than RM50 million. Principal hubs will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 effective from year of assessment 2016 for a period of five years with a possible extension for another five years. The fixed income tax rate for non-resident individuals be increased by 3 from 25 to 28 from YA 2016.

Taxable Income RM 2016 Tax Rate 0 - 5000. Companies incorporated in Malaysia with paid-up capital of MYR 25 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on. The corporate tax rate in Malaysia is collected from companies.

The basis period for a company co-operative or trust body is normally the financial year ending in that particular YA. Tax Rate of Company. All income of persons other than.

On first RM600000 chargeable income 17. Company with paid up capital not more than RM25 million. Corporate tax rates for companies resident in Malaysia.

Hantar anggaran cukai secara e-Filing e-CP204 atau borang kertas CP204 ke Pusat Pemprosesan Maklumat LHDNM secara manual. That does not control. Pay Your Tax Now or You Will Be Barred From Travelling Oversea.

2016 Special tax rates apply for companies resident in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment provided not more than 50. Wef YA 2016 tax rates for resident individuals whose chargeable income from RM600001 to RM1000000 be increased by 1 and chargeable income exceeding RM1000000 increased by 3. Your Chargeable Income RM4044944 RM9000 RM2000 RM449444 RM25000.

Such SMEs must not be part of a group of companies where any. Tekun will allocate a total of RM600m. Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT Table provides a view of individual income tax rates and Corporate Income Tax Rates in Malaysia.

Companies are taxed at the 24 with effect from Year of Assessment 2016 while small-scale companies with paid-up capital not exceeding RM25 million are. Deductions not allowed under Section 39 of Income Tax Act 1967. Governments budget for 2014 stated that the corporate income tax rate in Malaysia would be reduced to 24 per cent in 2016.

Malaysia Personal Income Tax Rates 2013. RM500m for Bumi entrepreneurs RM100m for 10k Indian business owners. Corporate companies are taxed at the rate of 24.

Dari luar Malaysia bagi syarikat insurans pengangkutan laut dan udara dan perbankan sahaja. Revenue to grow 14 to RM2257bil on higher tax revenue in 2016. 5001 - 20000.

Based on the tax rate table above RM25000 would be taxed RM150 on the first RM20000 and RM250 on the remaining RM5000 which brings it up to about RM400 in tax. Year ending 31 December 2016. Resident SMEs with a paid-up capital in respect of ordinary shares of RM25 million and below at the beginning of the basis period for a year of assessment are taxed at a preferential tax rate of 18 instead of the normal rate of 24 for the first RM500000 of its chargeable income.

GST collection up RM39bil from RM27bil in 2015. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. 20001 - 35000.

The amount from this is based on the total income that companies obtain while having a business activity every year. Rate The standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie. Tax relief for each child below 18 years of age is increased from RM1000 to RM2000 from year of assessment 2016.

The revenue from the tax rate is a major source of income in Malaysia. Tax relief for individual taxpayer whose spouse has no income is increased from RM3000 to RM4000. The income is generally subject to tax under the normal rules for residents.

A company registered under the MICSEZ is entitled to enjoy certain exemptions and relief from taxes see the Tax credits and incentives section for details. For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24. Tax Rate of Company.

Effective from year of assessment 2015 individual income tax rates will be reduced by 1 to 3. 25 percent 24 percent from Year of Assessment YA 2016. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

The carryback of losses is not permitted. 25 percent 24 percent from Year of Assessment YA 2016 Special tax rates apply for companies resident in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment provided not more than 50 percent of the ordinary. Maximum tax bracket will be increased from exceeding RM100000 to exceeding RM400000.

Corporate tax rates for companies resident in Malaysia is 24. Prior to 1 October 2021 the corporate tax rate was 25. Income Tax The tax rate on any income distributed by a unit trust to a unit holder which is a non-resident company is reduced from 25 to 24 for YA 2016 and onwards.

Resident company with paid-up capital above RM25 million at the beginning of the basis period 24. Company Taxpayer Responsibilities.

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000 2020 Historical Chart

Ready For Record Breaking Ramadan Marketing Infographics Ramadankareem Ramadanmarketing Marketingstrategies Lmws Infographic Marketing Marketing Ramadan

Rates For Regular Gym Memberships At Miracles Fitness At The Garage Ocean View Gym Membership Fitness Membership Garage Gym

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

The Malaysia Budget 2015 Will Be Announced By Datuk Seri Najib Razak On October 10 2014 At The Parliament This Infographics Sho Budgeting Infographic Malaysia

Namibia Visit 2 1 Http Ditsysdisco Blogspot Com 2016 08 Namibia Visit 2 1 Html We Were In Namibia Around Lunch Time After G Namibia Road Tax Visiting

In The Household Expenditure Survey Report 2019 Released Today Dosm Noted That The Increase In Average Or Mean Monthly Household Spen Household Johor Selangor

Corporation Tax Europe 2021 Statista

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

Global Corporation Tax Levels In Perspective Infographic Global Corporation Infographic Corporate

Company Tax Rates 2022 Atotaxrates Info

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Update On Anti Dumping For Some Monosodium Glutamate Msg Food Additives Food To Make Asian Cuisine

Estonia Corporate Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical Chart

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

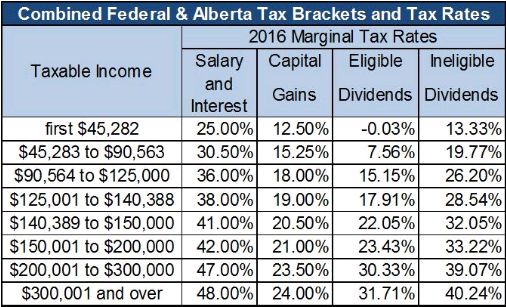

2016 Alberta Budget Capital Gains Tax Canada

Depending On Your Target Audience And Its Needs Taxation Laws The Nature Of The Local Workforce And Ot Corporate Tax Rate World Economic Forum Business Goals